FAQs

Patient care is complex. Insurance doesn't have to be.

Contact Information

The best way to connect with Sidecar Health is through the Sidecar Health Provider Portal. If you require additional assistance, please call us at (866) 441-9993 or email us at provider@sidecarhealth.com. A member of our Provider Relations team is ready to help you.

General Information

Since 2022, Sidecar Health has issued fully insured and administered both fully insured and self-funded large group major medical health plans that provide members with a more transparent and flexible way to access healthcare. Sidecar Health plans lower costs for patients and providers by putting members in the driver’s seat of their healthcare through transparency and eliminating restrictions – like restrictive networks and prior authorizations – that have become commonplace with legacy insurance.

Providers make care decisions. We pay for them.

Unlike legacy insurance plans, we do not require barriers to healthcare to manage our costs. Instead of prior authorizations, obstructive medical management programs, formularies, etc., we place our trust in providers to make the appropriate care decisions for our members.

We let providers determine their own rates.

Providers, not Sidecar Health, set the prices for their services – prices that they think are fair for the services being provided. Rather than a traditional network, we give members the flexibility to choose any healthcare provider without worrying about limitations.

Our members are engaged healthcare consumers with incentives that will reshape US healthcare.

Sidecar Health is creating engaged healthcare consumers through transparency and incentives. We don’t differentiate the amount we pay for covered services (the Benefit Amount). Our Benefit Amount is equivalent to commercial reimbursement and is set based on what a typical provider would accept as payment in full for a given service. On the Sidecar Health app, we share the prices providers have chosen as well as the Benefit Amount. Our members use that information to make informed decisions on where to seek care.

Members can pay directly

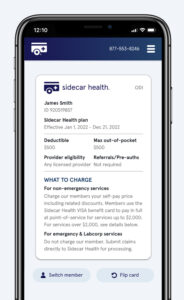

We provide members with a Sidecar Health Visa they can use to pay for medical services directly for a faster, easier payment. Providers are paid in full and don’t have to chase cost-sharing or bad debt from patients – we work that all out with the member directly.

The same as any other commercial plan, Sidecar Health patients have a digital ID card with membership information. You can also verify member information through the Sidecar Health Provider Portal. Serving Sidecar Health members is straightforward — you set the price, and a major insurer backs the payment, often at or before the time of service. This is not meant to be your charity/indigent rate. This is meant to be the rate you think is fair for the services you are providing.

No, Sidecar Health does not require prior authorization for any covered services, or impose other requirements, like step therapy, that interfere with patient care. If you would like to confirm if a service is covered, you can verify that information through the Sidecar Health Provider Portal.

Provider Portal and Account Setup

Any provider can request a login for the Sidecar Health Provider Portal, but you must have a registered provider domain. Email addresses from free, publicly-available services like Gmail, Yahoo, etc., are not accepted.

Please contact us via email to request access to the portal.

Upon completion of request form, you should receive an email with login credentials within 1-2 business days.

Because Sidecar Health doesn’t have a provider network, we don’t require traditional credentialing. However, we do appreciate receiving an up-to-date provider roster. This helps us ensure the accuracy of our provider portal and ensure that our members have the most accurate information when selecting care.

Yes, Sidecar Health’s highly popular member portal acts as a patient referral marketplace. Members use this portal to see provider prices for covered services, empowering them to compare their Benefit Amount (the amount Sidecar Health pays for covered services) and make informed decisions about their healthcare.

We believe that Sidecar Health’s innovative value propositions through our fast, easy, cash payments provide incredible value for most providers. However, in certain situations, we offer direct billing agreements. If you're interested but unsure whether you’re a good fit, please fill out this form.

Billing and Claims

Yes, Sidecar Health can accept claims directly from providers in the following three scenarios:

- The claim is subject to NSA protections, such as emergency room claims,

- The patient has other insurance that coordinates benefits with Sidecar Health, or

- You prefer to receive payment through a more traditional revenue cycle and have a “direct bill agreement” with Sidecar Health.

If a provider submits a to Sidecar Health and one of the above doesn’t apply, we are required to reject the claim for lack of verified assignment of benefits from the Sidecar Health member. We will direct the provider to send the itemized medical invoice to the patient who will pay the provider directly using the Sidecar Health Visa.

You shouldn’t in most cases (see above). Patients can pay you directly at the time of service using their Sidecar Health Visa. Before the patient leaves, they will request an “itemized medical invoice” or “superbill” to submit to Sidecar Health through our app. Ensure this document includes the following essential information:

- Patient’s full name

- Provider’s name, address, and NPI

- Date(s) of service

- Itemized procedure codes (CPT/HCPCS) with charge amounts

- Diagnosis codes (ICD-10)

Provider resources specific to COB are available at sidecarhealth.com/providers/claims/. Billing instructions are on the back of the member’s COB card and digital member ID card. You can also call our team for assistance.

Cash Payments and Pricing

While many providers opt to use their cash-pay rates for simplicity, you also have the option to create a custom fee schedule tailored specifically for our members. If you choose to go this route, we are here to assist you. You can choose your preferred percentage of Medicare (e.g., 120% of Medicare reimbursement), or we can provide benchmarks for average cash-pay rates in your area, helping you establish fair and competitive rates that both attract patients and support the profitability of your practice.

No – you may collect payment from patients whenever you like.

Many providers opt to collect a deposit or estimated payment up front, which can be refunded or supplemented later once the final costs are determined. All Sidecar Health members are provided with a Sidecar Health Visa to pay for covered services. This helps ensure steady cash flow for your practice and clearly communicates the patient’s financial responsibilities.