Health insurance that puts savings back where they belong: With you and your employees.

With transparency and control, Sidecar Health rewards employees with half the savings for smart decisions while cutting waste and lowering costs for everyone.

Other carriers don't want you to know about us. It's time you do.

How it works

Sidecar Health employer sponsored plans are designed with empathy to ensure your employees have the tools and information they need to be in control of their healthcare.

Employees can pay for any care they need

Access information to decide on their care

And are incentivized to make smart care decisions

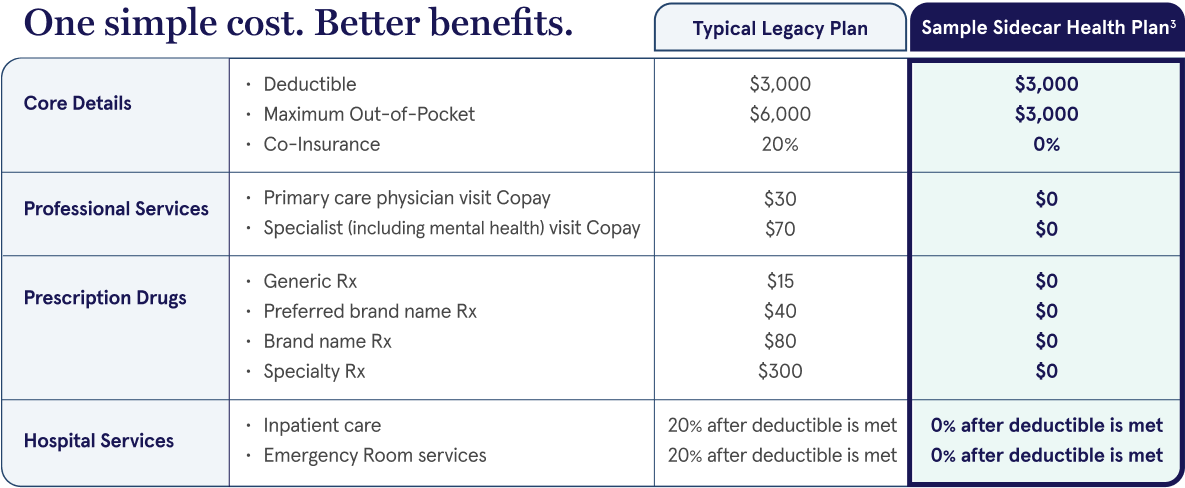

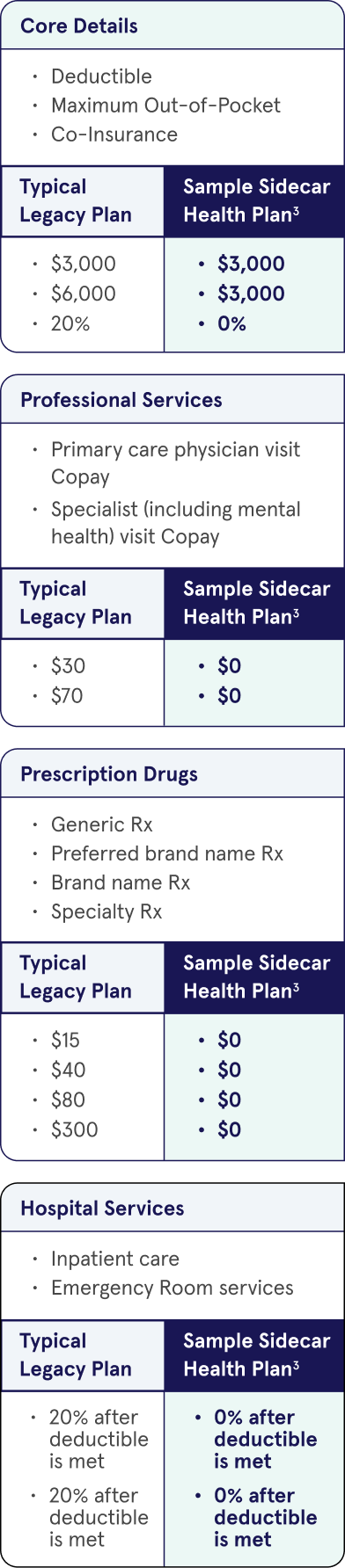

Lower out-of-pocket costs for your employees

Unlike legacy insurance plans that cut costs by reducing benefits, Sidecar Health lowers expenses and increases benefits by incentivizing members to make cost-conscious decisions.

Lower

out-of-pocket costs 1

Sidecar Health pays more per member on covered healthcare costs than legacy insurance plans which translates into lower costs for members.

No copays or

coinsurance

Get full access to covered services without paying any additional fees.†

Never pay more

than the deductible

The only out-of-pocket cost a member has to pay is their deductible. Period.†

Lower premiums

vs legacy plans 1

Employers save on premiums while employees enjoy more robust benefits.

Finally, benefits your employees will thank you for

Unmatched

freedom and access

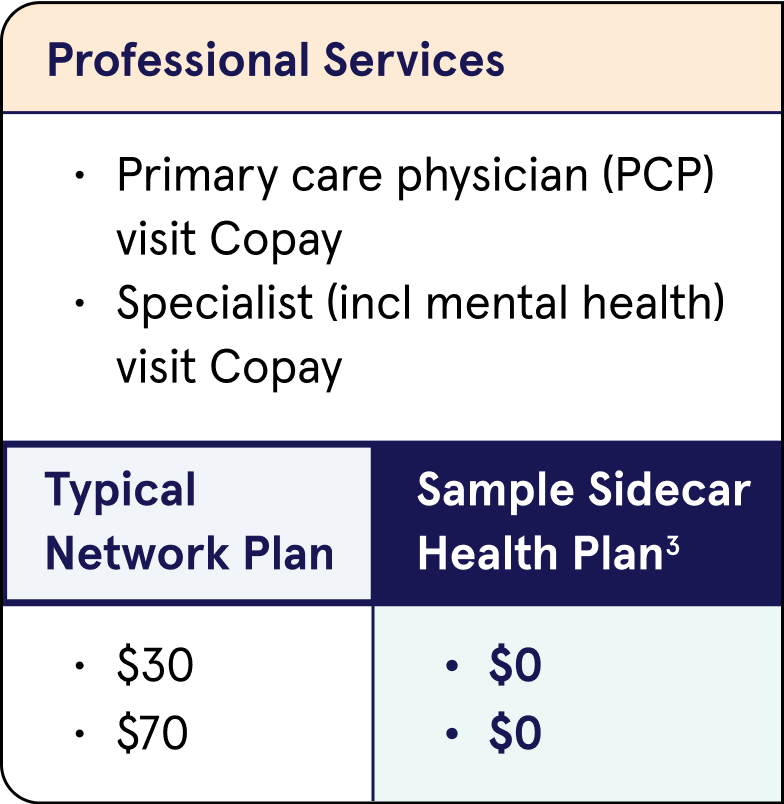

Your employees can see any doctor, get prescriptions without hassle, visit specialists without referrals and receive treatment without prior authorization. They’ll also benefit from generous physical and speech therapy limits, plus unlimited mental health visits.

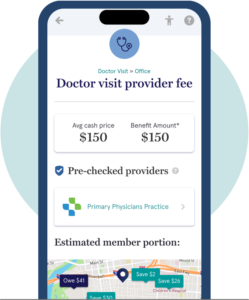

Crystal clear coverage

Know how much Sidecar Health pays upfront, with transparency that puts members in control.

Total protection

Peace of mind your employees won’t have to worry about surprise bills, even for emergencies or unexpected procedures. (deductibles apply)

Our team is your team

Reach a real person 7 days a week via chat, message or phone, and get support from a true employee health benefits partner, not just an insurer.

We're serious about mental health

Your employees' wellbeing matters, and they should have access to mental healthcare without having to worry about networks or out-of-pocket costs. Sidecar Health members have access to unlimited mental health visits and the freedom to choose any provider.

Insurance that's loved by CFOs and employees alike

Sidecar Health offers a win-win solution with 10%+ lower premiums* for employers and better access to quality care for employees. By incentivizing employees to seek cost-effective care without sacrificing quality, we empower them to make informed healthcare decisions and even earn cash back when they save on care. Everyone benefits - employers save on premiums, and employees are rewarded for making smart, value-driven choices.

Interested in learning more?

Interested in learning more?

Our dedicated team is here to better understand your unique needs and customize an approach that works for your business. Fill out the form and we will be in touch soon.

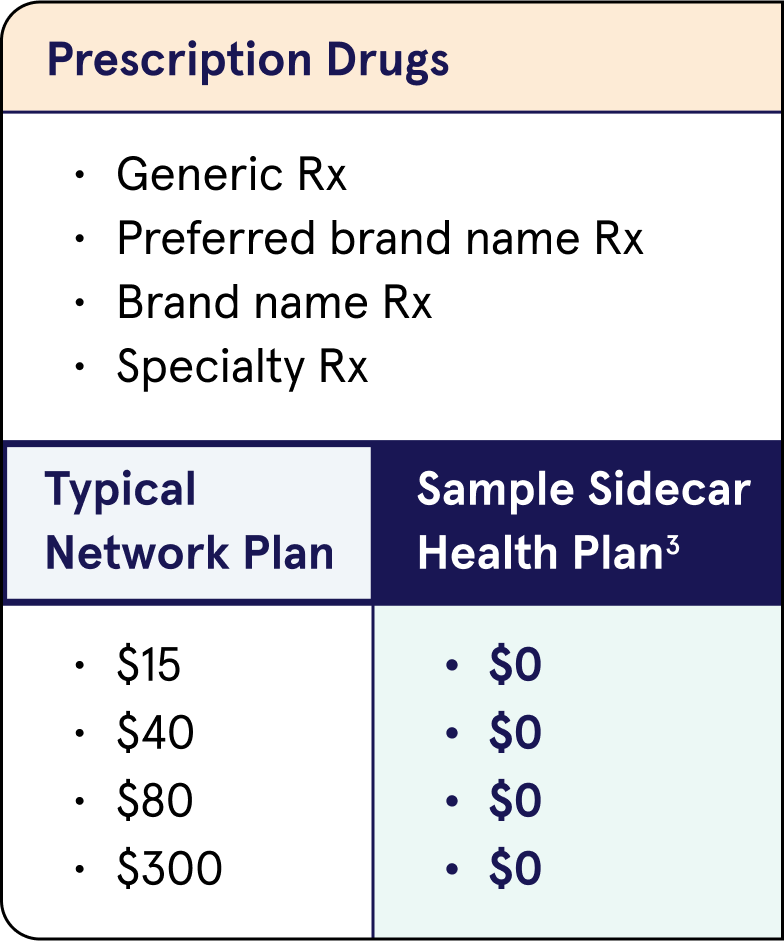

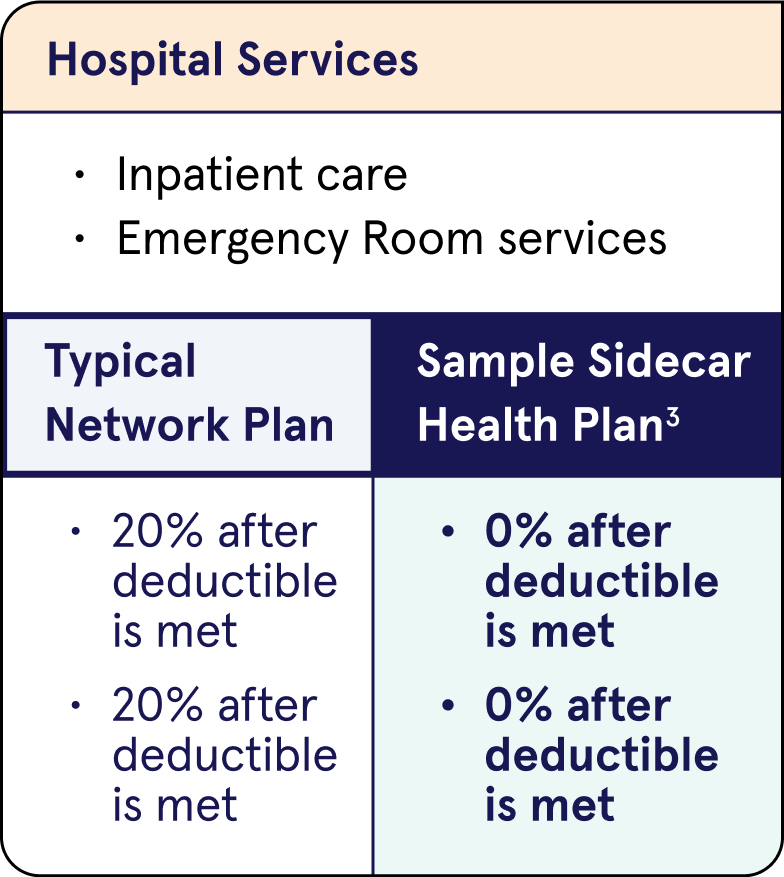

1. Based on comparison of Sidecar Health First Dollar coverage plan with $3k deductible and no coinsurance or copays to typical network major medical plan with $3k deductible, 20% coinsurance, and copays ranging from $15-$300/covered service.

2. Estimated savings from Sidecar Health plans quoted 6/1/23 - 3/31/24 compared to traditional group health plans. Specific pricing may vary.

3. Sample Sidecar Health plan with First Dollar Coverage

* Estimated savings compared to traditional group health plans. Specific pricing may vary. "Half the savings" and "cash back" refers to Earned Benefit. See Certificate of Coverage for details.

† Assumes care is at or below the Benefit Amount.